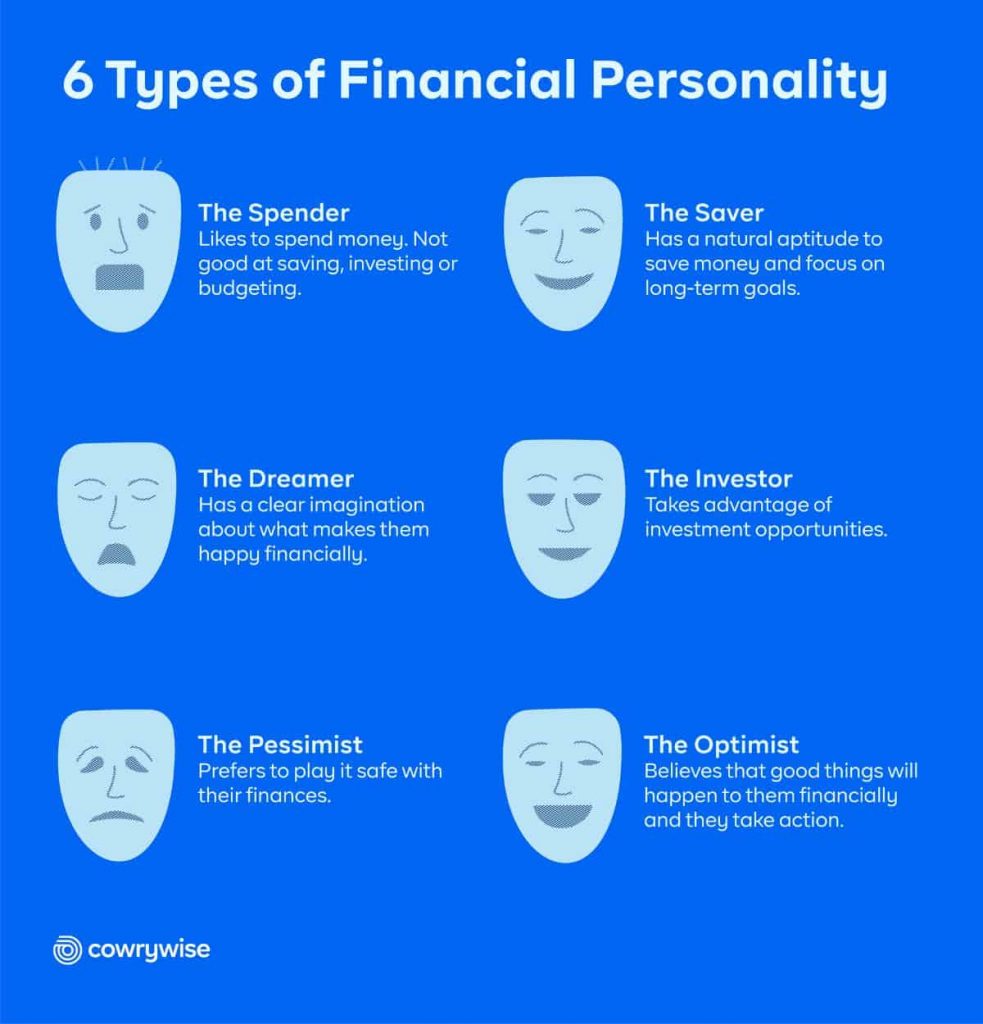

Our Approach to Financial Assessment

At FinanceInsight, we believe that financial well-being is deeply personal and influenced by both psychological factors and practical financial management. Our assessment tools are designed to provide a holistic view of your financial self.

We combine behavioral finance principles with practical financial metrics to deliver insights that are both meaningful and actionable. Our goal is to help you understand your unique relationship with money and provide personalized guidance for improvement.